"Top-drawer"

Several members of chambers are frequently instructed in direct and indirect tax litigation and investigations in the following areas: corporation tax, capital gains tax, inheritance tax, VAT, income tax; and in the context of EU law, tax harmonization, excise duty, VAT, special levies, international transactions, tax and State aid and WTO subsidies.

We have particular experience of acting in litigation arising out of tax avoidance schemes involving various financial instruments and transactions including, for example, disposal of discounted securities, issue of insurance bonds, derecognition of loan relationships, conversion of loan notes and lapsed foreign exchange provisions in qualifying corporate bonds. We have acted in cases concerning the tax implications of share issues and mergers, of payments into employers’ unapproved funded / unfunded benefit schemes and in challenges to levies including betting levies, airline passenger duty and environmental levies. Other litigation in which we have been involved includes VAT carousel fraud and transfer pricing cases.

Our clients include HMRC, individuals, companies and trade associations.

Chambers UK 2021

Philip Jones KC: "A lovely man who is intellectually very able."

Legal 500 2021

Philip Jones KC: "Affable and technically knowledge. He is also good at providing realistic timescales."

Mead Johnson Nutrition (Asia Pacific) and Others v Commission:

Judgment of the General Court in Case T-508/19 Mead Johnson Nutrition (Asia Pacific) and Others v Commission: partial annulment the Commission decision finding non-taxation of royalty income in Gibraltar constituted unlawful State Aid.

On 6th April 2022, the EU General Court handed down a decision in relation to non-taxation of royalty income in Gibraltar (the Gibraltar Corporate Income Tax Regime) in Case T-508/19, partially annulling Commission Decision 2019/700 of 19 December 2019 on the grounds of procedural deficiencies of the Commission.

Conor Quigley QC acted for the successful applicants, instructed by PwC. Conor is one of the UK’s leading expert barristers in State Aid law. The 4th edition of European State Aid Law and Policy will be published in Summer 2022.

To read the judgment, please click here.

The Union Castle Steamship Company Ltd v HMRC [2020] EWCA Civ 547:

In The Union Castle Steamship Company Ltd v HMRC [2020] EWCA Civ 547 a case concerning the use of derivative contract rules to engineer tax deductible losses exceeding £100m, the Court of Appeal clarified the meaning of ‘loss’ and ‘arising from’ and the nature of the ‘fairly represents’ test in that context. The earlier decision of the Upper Tribunal also extended the application of transfer pricing rules to certain shareholder transactions (bonus share issues). Ruth Jordan acted for HMRC.

Please click here to view the judgment.

The Upper Tribunal (Tax and Chancery Chamber) has handed down its decision in Walkers Snack Foods Limited v HMRC [2025] UKUT 00155 (TCC)

The UT dismissed Walkers Snack Foods Limited’s appeal against the FTT’s decision that Sensations Poppadoms are ... Read More

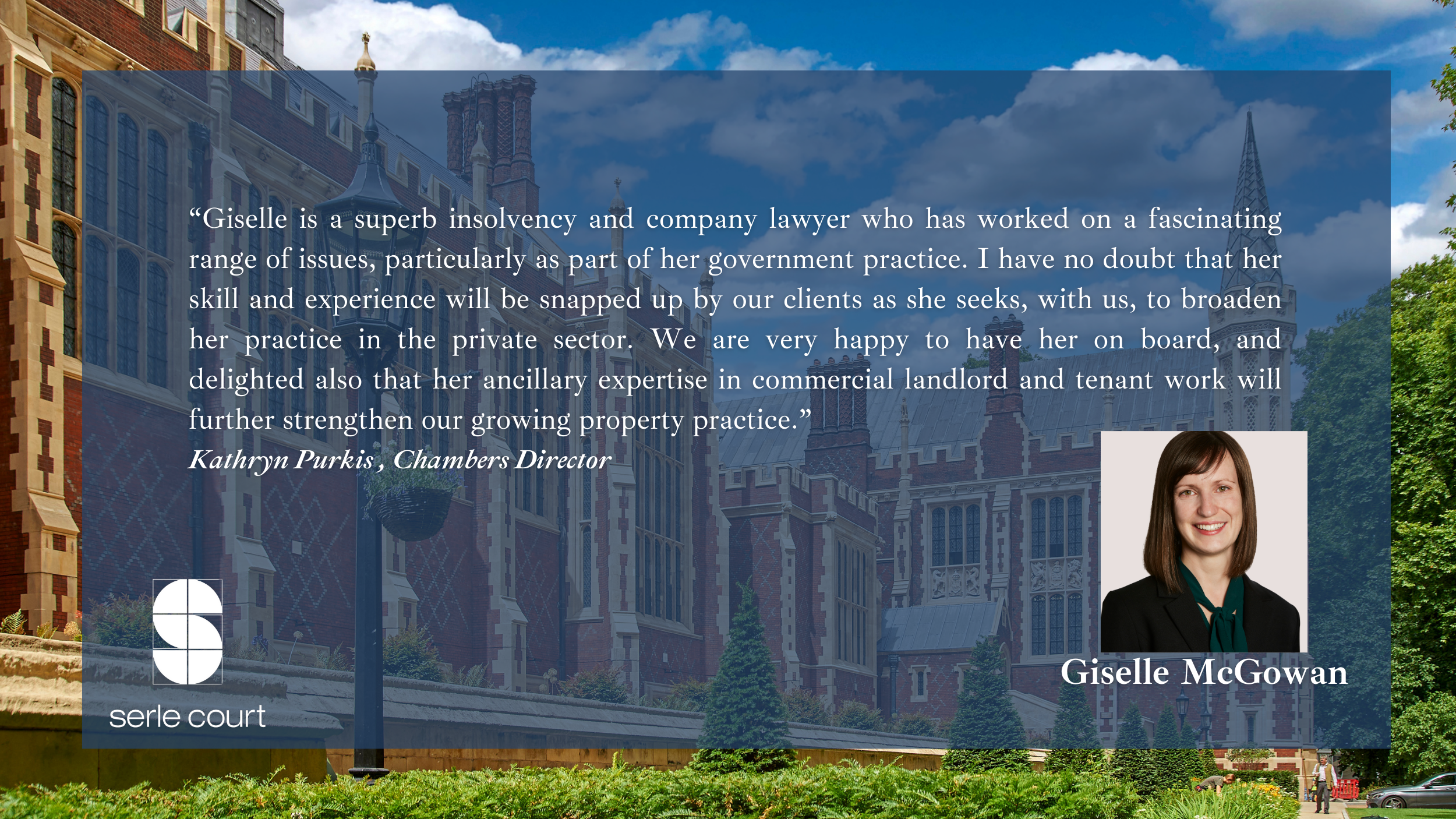

Leading commercial chancery barrister joins Serle Court

Serle Court is pleased to announce that leading commercial chancery Giselle McGowan has joined Chambers. Giselle’s practice covers... Read More

The Upper Tribunal (Tax and Chancery Chamber) has handed down its decision in Walkers Snack Foods Limited v HMRC [2025] UKUT 00155 (TCC)

The UT dismissed Walkers Snack Foods Limited’s appeal against the FTT’s decision that Sensations Poppadoms are ... Read More

Leading commercial chancery barrister joins Serle Court

Serle Court is pleased to announce that leading commercial chancery Giselle McGowan has joined Chambers. Giselle’s practice covers... Read More